Annual Hsa Contribution Limit 2025

Annual Hsa Contribution Limit 2025. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. 2025 hsa contribution limits released.

This is still good news for hsa owners as the contribution limits will rise again for 2025. Hsa contribution limit for self coverage:

The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,150 (up $50 from 2025).

Maximize an HSA to fund Medicare and other health expenses, The irs has announced its health savings account (hsa) contribution limits for 2025. You can contribute up to.

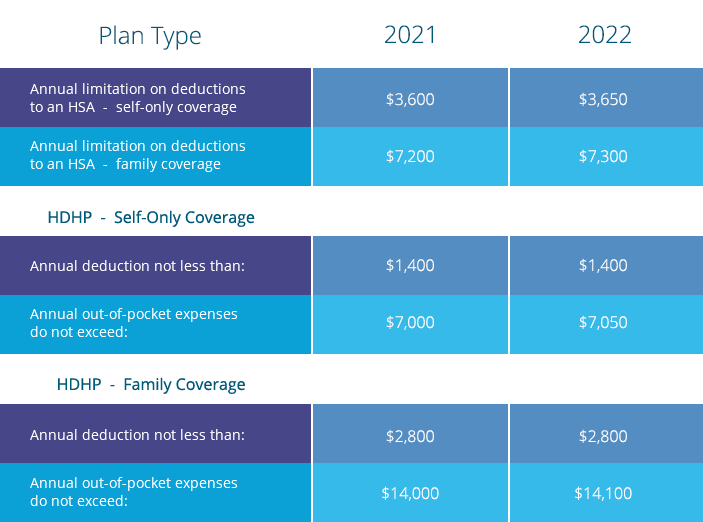

HSA Contribution Limits Guided Benefits Blog, Employer contributions count toward the annual hsa contribution. The 2025 calendar year hsa contribution limits are as follows:

Savings Boost IRS Raises HSA Contribution Limits for 2025, To contribute to an hsa, you must be. The irs has announced updated financial limits for health savings accounts (hsas) and high deductible health plans (hdhps) for the 2025 plan year.

2025/2025 HSA Limits Corporate Benefits Network, The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,150 (up $50 from 2025). This is still good news for hsa owners as the contribution limits will rise again for 2025.

Health Savings Account (HSA) Ameriflex, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. Those age 55 and older can make an additional $1,000.

Fillable Online The IRS limits your annual contributions to a health, Those age 55 and older can make an additional $1,000. The 2025 aca maximum is $9,200 for individual coverage (versus $9,450 in 2025) examples of compliant hsa/aca plans:

IRS Announces 2025 HSA Contribution Limits, Hsa limits 2025 2025 over 50 ddene esmaria, the new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of. For family coverage, the maximum annual hsa.

IRS Announces 2025 HSA Limits Blog Benefits, The irs has announced updated financial limits for health savings accounts (hsas) and high deductible health plans (hdhps) for the 2025 plan year. The irs has announced its health savings account (hsa) contribution limits for 2025.

HSA Contribution Limits and HDHP Requirements — Ascensus, The 2025 calendar year hsa contribution limits are as follows: Recordhigh 2025 hsa contribution limit ppl.

2025 HSA contribution limits increase considerably due to inflation, The maximum contribution for family coverage is $8,300. Employer contributions count toward the annual hsa contribution.

The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,150 (up $50 from 2025).

The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.

Equipment Rental WordPress Theme By WP Elemento